Part 4: Independant dentistry is still alive but under threat

Why Solo Practice Matters and How Patients Can Support It

Despite this corporate takeover of dentistry, #independent dentistry still exists—but it's under constant pressure. Independent dentists have no quotas, no outside contracts, and no corporate managers telling them how to treat patients. They use the labs, materials, and staff they trust. They build real relationships with patients—not volume-driven encounters.

But these dentists must also fight uphill battles: shrinking insurance reimbursements, patient expectations set by chain pricing, and an online reputation ecosystem stacked against them. Meanwhile, DSOs continue to buy up private practices and employ new graduates under contract-heavy, commission-based models—essentially enslaving the next generation of dentists to a system that puts business before care.

Many dentists are leaving the profession because they simply cannot compete with the insurance-corporate ecosystem. Imagine needing $10 to do a job properly, but being forced to do it for $2. Why would anyone want to get their hands dirty under those conditions?

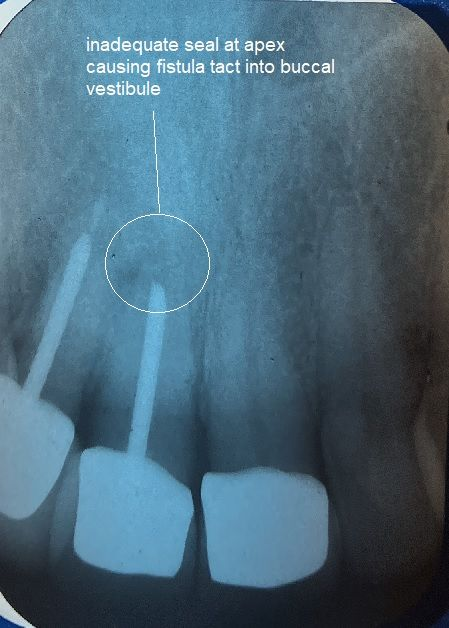

Simply put, the dental market is controlled by profit-driven insurance companies that have no regard or liability for the quality of dentistry they market as their product. These companies prioritize cutting costs and maximizing profits over patient care.

Insurance companies sell policies with fine-print limitations, exclusions, and language specifically crafted to reduce payouts and increase profits. They are not engaged in the practice of dentistry, do not perform procedures, and are not licensed healthcare providers. Their "recommendations" should be viewed not as medical advice, but as financial strategies designed to protect their bottom line. This creates a serious conflict of interest—one where the entity controlling access to care is not the one delivering it.

Price fixing in dentistry is prohibited by Florida law under the Florida Antitrust Act (Chapter 542, Florida Statutes).

Despite the law insurance companies and DSOs often engage in practices that effectively fix prices through contracts and networks, limiting competition and patient choice. You can read more about Florida’s antitrust laws here: Florida Antitrust Act - Chapter 542.

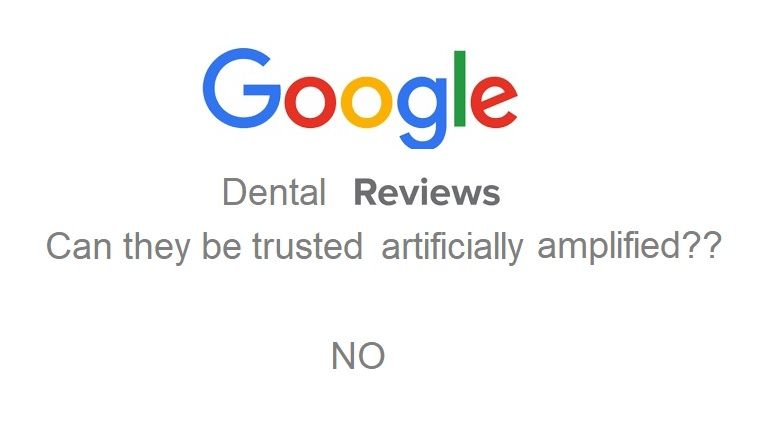

Patient Behavior: Seeking Dental Care Inside vs. Outside Insurance Networks

According to the 2022 American Dental Association (ADA) Health Policy Institute report, approximately 40% of patients have sought dental care outside their insurance network for better quality dental care.

- A 2023 Delta Dental Consumer Oral Health Survey found that around 35% of patients delayed or avoided treatment due to insurance restrictions or concerns about out-of-pocket costs, highlighting the impact of insurance limitations on dental care decisions.

- The National Association of Dental Plans (NADP) reports that nearly 60% of insured patients choose dentists primarily based on their insurance coverage, often restricting patient choice and access.

- Research published in the Journal of the American Dental Association (JADA) suggests that patients who receive care from out-of-network dentists often report higher satisfaction rates and better health outcomes, emphasizing the value of independent dental practices.

Sources:

- ADA Health Policy Institute Report 2022: ada.org/en/publications/ada-health-policy-institute

- Delta Dental Consumer Oral Health Survey 2023: deltadental.com

- National Association of Dental Plans (NADP): nadp.org

- JADA Research Article: jada.ada.org

At our office, we answer only to one authority: you, the patient. We don’t accept insurance contracts that compromise care. We don’t work under franchise quotas. We provide honest, full-service dentistry tailored to your needs—not to corporate spreadsheets.

Choose care without compromise.

#OutOfNetworkDentist #DentalTruth #DSOExposed #InsuranceScam #TransparentDentistry

#QualityOverQuotas #PatientOverProfit #EthicalDentistry #IndependentDentist

#RealDentalCare #NoInsuranceNoProblem #RiverviewDentist #33578Dentist

#BestDentistNearMe #ChooseYourDentist