Dental Insurance & Payment Options in Riverview, FL

Chris A. Castellano DMD PA – Riverview, FL 33578

Your smile is important. At Chris A. Castellano DMD PA, we want to make quality dental care affordable and accessible for every patient—whether you have insurance or not.

Located conveniently on US Hwy 301 S in Riverview, we serve patients from Apollo Beach, Brandon, Wimauma, Ruskin, and beyond. We accept most major PPO dental insurance plans and will work closely with you to help maximize your benefits.

We Work with Most Major PPO Dental Insurance Plans

While we are not in-network with any dental insurance providers, we routinely work with patients who carry PPO plans. Most PPO dental insurance plans allow you to choose any licensed dentist, even if they’re out of network. Our team will provide a courtesy estimate and help you understand how to help you maximize your dental insurance benefits.

We frequently assist patients who carry:

- Aetna dental insurance Riverview FL

- Delta Dental providers Riverview 33578

- UnitedHealthcare dental in Riverview

- Cigna dental dentists Riverview

- Humana dental coverage Riverview

- MetLife dental Riverview

- Guardian dental insurance Riverview FL

- Florida Blue dental plans Riverview

- Anthem Blue Cross dental Riverview

- Ameritas dental Riverview dentists

- Principal dental insurance Riverview

- United Concordia dental Riverview

- GEHA dental plans Riverview

- Mutual of Omaha dental Riverview

- Sunlife dental coverage Riverview

- Renaissance Dental insurance Riverview

- US Health Group dental dentists

- Assurant dental insurance Riverview

- Aetna Medicare dental Riverview

- Always Care dental insurance FL

- Boon Chapman dental Riverview

- Lincoln Financial dental in-network

- Manhattan Life dental insurance FL

- Meritain Health dental Riverview

- Physician’s Mutual dental plans

- Reliance Standard dental coverage

- Standard Life dental insurance FL

- SuperDental plans Riverview

- Teamcare dental insurance FL

- Everglades Dental Studio insurance

- Envolve Dental of Florida plans

- DentaQuest dental insurance Florida

- EMI Health dental plan FL

- Dominion National dental FL

- Humana Gold Plus dental plan

- Aetna CVS Health HMO dental

- CVS Health dental insurance FL

- PPO dentist Riverview Aetna Cigna

- PPO dental in-network Humana MetLife

- HMO dental Riverview FL plans

Our team is happy to file claims on your behalf, estimate your coverage, and help you understand your out-of-pocket costs. Most PPO plans offer out-of-network benefits that can still significantly reduce your treatment costs.

Not sure if your plan works with us? Call our office at 813-672-1917 or contact us to check your coverage.

What If We’re Out-of-Network?

If your dental plan allows you to choose any dentist (most PPO plans do), you can still use your insurance benefits at our office. We’ll handle the paperwork, submit your claim, and help you estimate your out-of-pocket costs.

Even when we’re not in-network, many of our patients find excellent savings with out-of-network coverage combined with our:

- out of network discounts

- full service dentistry

82% of dental insurance is PPO. PPO Insurance allows you to select your dentist out of network. Yes we accept it!

Payment Options Beyond Insurance

We also offer a variety of payment solutions for patients without insurance or with limited coverage:

- CareCredit – Easy financing with low monthly payments

- Scratchpay – Flexible dental financing options

- Cash discounts – Ask about our same-day payment savings

- Credit cards – We accept all major credit cards

- Payment plans – Personalized, in-office plans for qualifying treatments

Why Choose Us?

Since 1999, Dr. Chris A. Castellano has built a trusted reputation in the Riverview community by offering compassionate, affordable care. Our full-service office provides everything from dental implants, root canals, and dentures to emergency appointments and Saturday visits.

We're proud to treat generations of families — and we'll help you get the most value from your insurance or payment plan.

30 Common questions people ask about insurance and our practice.

Why We Choose to Be Out-of-Network

Honest Dentistry. Real Doctor. No Corporate Quotas.

The Problem with Insurance Networks

When a dentist signs a contract with a dental insurance company, they’re not just “joining a network”—they’re surrendering control of their professional judgment. These contracts require dentists to:

- Accept capped procedure fees, often 50–70% below fair market rates

- Follow strict limitations on coverage, regardless of what you actually need

- Use lower-cost labs, materials, and shortcuts just to stay profitable

- Refer out procedures they can’t profit from under the plan

It’s not just inconvenient—it’s dangerous. It turns patient care into a spreadsheet formula.

The Rise of DSO-Controlled Chain Dentistry

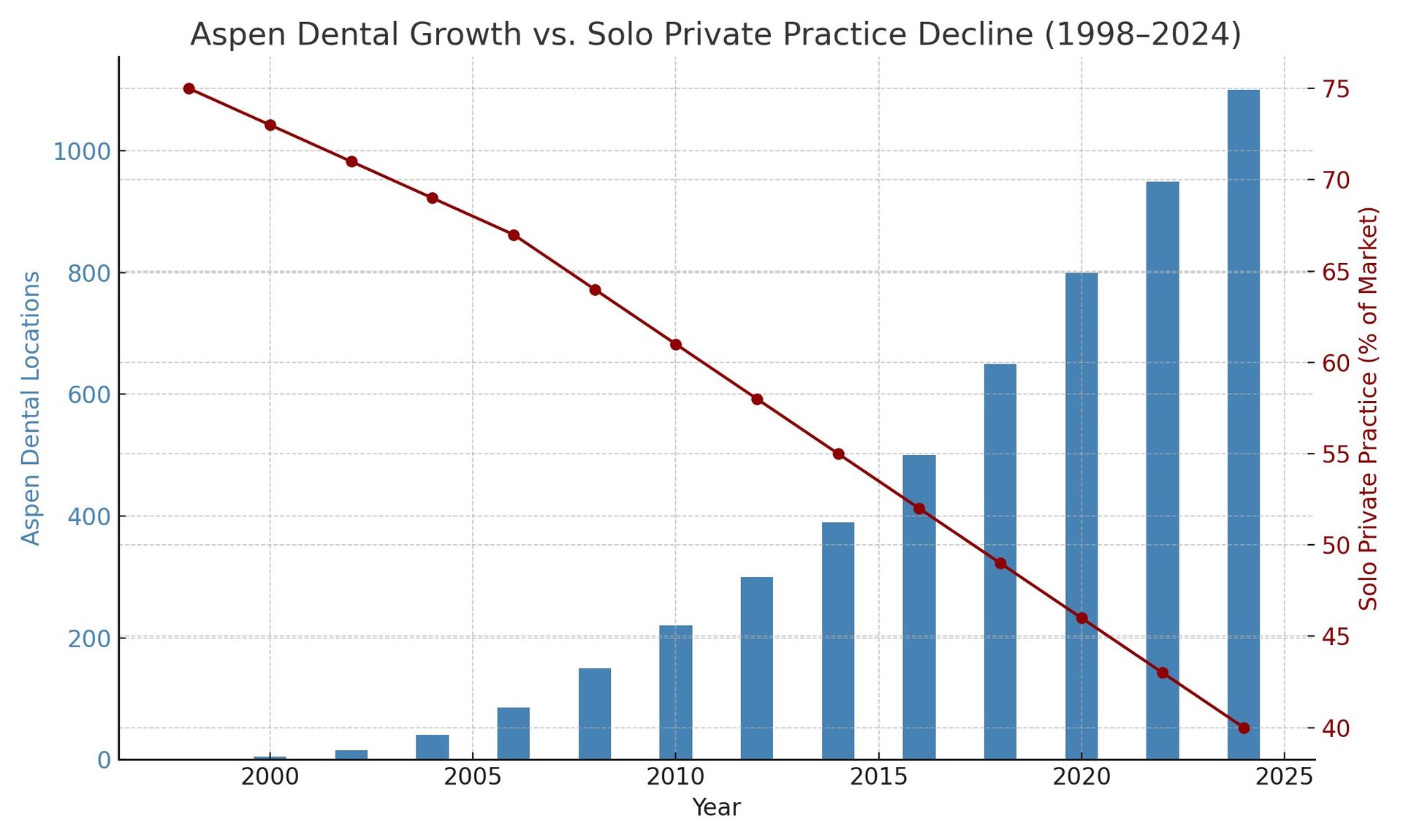

Over the last two decades, dentistry has been transformed by the explosion of DSOs—Dental Service Organizations. These chains now dominate much of the market and exist for one main reason: to serve insurance companies by cutting costs to them thus increasing their profits.

Here's how it works:

- By design, DSOs standardize care with a one-size-fits-all approach

- They reduce operational costs (bulk materials, templated procedures)

- They accept lower PPO reimbursement rates in exchange for access to large patient pools via insurance networks

- They focus on volume, not quality—because that’s how they make money

And legally? In Florida and many other states, dental practices must be owned by a dentist — Fla. Stat. § 466.026(1) & Fla. Admin. Code 64B5‑17.013(1) —but there’s no law limiting how many offices that dentist can own. Many DSO founders open multiple locations under one name, hire commission-based associate dentists, and leave the daily operations to a corporate operations manager trained in production—not healthcare.

You're Not Just a Plan Member. You're a Patient.

If you’re tired of:

- Rushed visits

- Sales pitches disguised as treatment

- Seeing a different provider at every appointment

- Feeling like a number instead of a person

Then it’s time to try something different.

You have PPO insurance.

Use it where it matters: with a dentist who works for you—not your insurance company.

Follow the Money: Commission-Based Dentistry

The typical dental office you walk into today may look independent — but behind the scenes, many are no longer run by your dentist. They’re controlled by business managers, investment groups, and insurance contracts.

Here’s how the money flows — and why it affects your care.

The DSO Model: Corporate Dentistry in Disguise

- The DSO and dentist owner make a franchise agreement in which the DSO handles supplies, marketing, branding, pricing, insurance contracts, staff training, and equipment

- a corporate business lawyer, CPA, and several office managers (most valuable employee) are hired to run each location.

- Associate dentists are hired on 20% commission based on 50–70% reduced insurance fee schedules, often right out of school, and groomed into corporate compliance, franchise protocal — not sound clinical judgment.

- Patient flow comes from insurance company marketing, not reputation or word-of-mouth.

- The dentist-owner signs on to as many PPO plans as possible, accepting 50–70% reduced fee schedules.

These corporate dentist-owners (seldomly there if at all) are then paid in two ways:

- Insurance subsidies — monthly “cooperation checks” for staying in-network to secure interests of the insurance company.

- 80% of associate production on all those 50–70% reduced fee schedules.

Meanwhile, the associates (actually doing the dentistry) clincal decissions are often dictated by:

- Which procedures pay the most commission This highlights the ethical dilemma between high-commission procedures and more conservative, lower-cost treatment options that may be in the patient’s best interest. In corporate and DSO settings, where associates are paid on commission—often based on inflated “production” rather than actual collections—and must meet corporate quotas, the system encourages over-treatment. Add in the 50–70% reduced PPO fee schedules, and the pressure to prioritize high-paying procedures intensifies. The result? Over-selling becomes standard practice, not an exception.

- What equipment is available (if any)

- What is profitable mentored by corporate management with quotas for optimal profits not an on site owner licensed dentist with his reputation at stake to do optimal patient care.

Cases that would ethicaly be treatmnet planned conservatively are not profitable in these-type corporate, franchised offices are unethically upgraded to make them profitable or referred out with quiet kickbacks from specialist to DSO management -owner dentist, or skipped entirely.

Enslaving the Next Generation of Dentists

These DSOs and chain dentals don’t just hurt patients — they exploit young dentists.

- Crushing student debt forces graduates to accept in-network DSO, chain dentals jobs just to survive.

- Non-compete agreements block them from starting their own practices nearby.

- No ownership path — just production quotas, no retirement track.

- No control over patient care — they follow instructions from managers to meet quatas, not the best patient care

- No mentorship — only metrics. Excellence is sacrificed for volume in these high volume one size fits all chain dental chains.

- The owner dentist's (often never practicing at any location) becomes their absentee master. The insurance company 50-70% reduced fee schedules becomes their guide for treatment planning.

- They do the work. They take the liability (malpractice) risk, but they build no repution for themselves.

- They are denied autonomy, ethics are compromised, and the second they speak out—they’re replaced. The machine just keeps running.

That leaves the question: Who’s running the show in corporate chain dental office?

- Not the dentist-owners—he’s a ghost figure, their to profit from his dental license, and satisfy the leagal ownership laws. HOW?

- leasing a dental licence to a corporation. Effectively giving ownership of the state license to the corporation for the period of the lease in exchange for a structured money reimbursement over the lease period with no say.

- maintaing his license with the state but using it to "franchise with a DSO" to open multiple locations with some say. In this model most of the time this "owner denstist" is not found actively practicing dentistry at any location.

- Not the associate dentist—they only make 20% commission, and their clinical autonomy is restricted.

- It’s the unlicensed office manager who:

Sets schedules

Enforces quotas

manages the cheapest labs and stocks supplies

Guides treatment paths based on profit—not patient need

This is a blatant reversal of the law’s intent putting corporation mangement over the dentist.

The law demands that dentists remain in control—not insurance executives nor operations staff. DSOs, however, invert this:

- Clinical decisions: dictated by

insurance fees and

volume quotas

- Accountability: diffused inside corporate structures

- The dentist's role: reduced to punching codes for procedures they may not even believe in

The net result? A massive conflict of interest:

- absentee owners dentist who's only goal is chasing profit

- Insurance companies

- Insurance companies raise premiums year after year while lowering the reimbursement rates they pay dentists—putting profits over patient care. By controlling over 150 million Americans through PPO plans1, they’ve created a monopolistic grip on dentistry. Once they secure a region with enough “preferred providers” (typically corporate DSOs, chain practices, and group clinics), they slash UCRs (Usual, Customary, and Reasonable fees), forcing contracted dentists to work for less2. This system funnels around 60% of patients into high-volume, low-cost corporate models3 while squeezing out independent, out-of-network dentists who provide more personalized, higher-quality care. The result is a race to the bottom—favoring insurance-aligned dental mills over relationship-based practices, all in the name of maximizing insurance company profits, not improving patient outcomes.

- Historically, UCRs were set by dentists in solo private practice—who made up 95% of the profession in the 1970s4. Today, that number has flipped, with approximately 80% of UCR influence coming from DSOs, chains, and corporate-run practices5. As independent dentists disappear, so does any meaningful control over pricing and the quality of care. It's no longer dentist versus dentist competing to deliver the best outcomes for patients—it’s corporate chain versus corporate chain, racing to the bottom, slashing fees and standards to appease insurance companies and maximize their profits at the expense of true healthcare.

- American Dental Association (ADA) Health Policy Institute.

"Nearly 150 million Americans have dental benefits, the vast majority through employer-sponsored plans."

Source: ADA HPI, Dental Benefits Coverage in the U.S. ↩ - ADA HPI Brief: "Reimbursement Rates for Selected Dental Procedures (2005–2014)"

Data shows average PPO reimbursement dropped between 5–15% in real terms over that period.

Source: ADA HPI Reimbursement Report (PDF) ↩ - Leavitt Partners (2020) DSO Market Report

Estimates place the DSO market share at 30–40%, with 60%+ of PPO plan participants routed to corporate chains in high-density areas.

Source: Leavitt Partners Dental Support Organization Study ↩ - Journal of the American Dental Association (JADA), 1970-1980 Archives

Private solo practices represented 93–95% of dental offices in the 1970s.

(Confirmed in ADA workforce trend archives, 1970–1980.) ↩ - ADA HPI & Group Dentistry Now

By 2025, DSO-affiliated practices may represent over 50% of all practicing dentists under 35, with large influence over regional UCRs due to volume contracting.

Sources: ↩

- Office managers drive production, not patient care

- Associate dentists are squeezed into performing to survive

Patients lose. Ethical dentists suffer. The next generation is ensnared and silenced as this model becomes the new standard of denstisty not dictated by health care professionals but a colussion of insurance comapnies with in-network DSO, chain dentals, and group corporate practices.

And the cycle continues — cheaper care, broken trust, and fewer dentists in control of their profession.

| Year | Out-of-Network (%) | In-Network (%) | Notes |

|---|---|---|---|

| 1970 | 95% | 5% | Nearly all dentists were fee-for-service. |

| 1975 | 90% | 10% | PPOs begin emerging. |

| 1980 | 80% | 20% | Insurer influence grows. |

| 1985 | 70% | 30% | Group practices expand. |

| 1990 | 60% | 40% | Employer dental plans rise. |

| 1995 | 50% | 50% | Market hits even split. |

| 2000 | 40% | 60% | DSOs and private equity grow. |

| 2005 | 35% | 65% | Franchised chains expand. |

| 2010 | 30% | 70% | DSOs mainstream. |

| 2015 | 25% | 75% | Chains dominate urban markets. |

| 2025 (est.) | 20% | 80% | Solo private practice nearly extinct. |

- 1. ADA Historical Archives – Trends in Solo Practice Ownership (1970–1980)

- 2. National Association of Dental Plans (NADP) – History of PPO and DMO development

- 3. Health Affairs – “The Changing Face of Dental Care Delivery” (1990s trends)

- 4. ADA Health Policy Institute – Dental Practice Ownership Trends

- 5. Becker’s Dental Review – “The Rise of DSOs: 2000–2015”

- 6. ADA Health Policy Institute – DSO Facts and Data

- 7. Pew Charitable Trusts – “Corporate Dentistry: Ownership, Access, and Accountability”

- 8. ADA + HPI Projections (2025 extrapolation)

The insurance companies have removed the solo practice dentist from seat driver and replaced him with a DSO chain dental. The probability that the decline of solo dental practices is causally linked to the expansion of DSO/chain dental practices through in-network insurance marketing and price-fixing is extremely high—not just correlation but a near-direct systemic connection. Here's why, using evidence, logic, and economic modeling:

Corporate Chains Are Spreading

This DSO model — essentially a dental franchise system — is growing fast. Large national chains like Aspen Dental and Heartland Dental run hundreds of locations, powered by bulk-bought supplies, standardized treatment protocols, and brand-first marketing.

In these systems:

- Dentists don’t choose their materials, labs, or schedules.

- Everything is standardized for speed and profit.

- Patient care is reduced to volume-based production.

In this model the chain makes all the decisions, the dentist is merely a commisioned clock puncher boxed in with very little professional freedom to do his best. This is very far cry from the past where the solo private practice dentist made all the decisions.

Cited sources included in chart:

- ADA Health Policy Institute (HPI)

- Aspen Dental press releases

- Industry trend reports and historical solo practice data

Why This Model Hurts Patients

- Care is dictated by insurance fee rules, not health needs.

- Associate dentists are paid on commission, incentivizing over-treatment or avoidance of complex cases.

- Rushed visits, minimal materials, and frequent referrals to specialists (often tied to kickback arrangements).

- Patients are treated like policy numbers, not people.

And when insurance companies control 90% of the dental market’s gateway (thanks to 150+ million Americans with PPOs), it becomes nearly impossible to break free. Dentists who go in-network get locked into a system where 99% of their patients come from the insurance company’s website — not their own efforts or standards.

Pulling out is like pulling the plug on your own patient base.

What the Insurance Companies Don’t Want You to Know

As soon as a zip code becomes saturated with in-network providers, insurance companies lower their fee schedules to increase profits. If providers start dropping out, they offer quiet subsidies (cooperation checks) to select “preferred” in-network dentists to bribe them into staying — not by raising fees, but by handing out fixed monthly checks wheather see patients or not.

This way:

- Insurance companies don’t have to raise fee schedules (which would cost them more across all claims)

- They keep the illusion of a robust network

- And they stay in control — of dentists and patients as the real end loosers.

| Procedure Code | Type | Reimbursement (% of Fee) 2005 |

Reimbursement (% of Fee) 2014 |

|---|---|---|---|

| D3310 | Endodontic – Anterior | 71.9% | 67.1% |

| D3320 | Endodontic – Bicuspid | 74.0% | 68.5% |

| D3330 | Endodontic – Molar | 77.3% | 72.7% |

| D4341 | Periodontal – Scaling/Root Planing | 82.6% | 70.6% |

| D4381 | Periodontal – Local antimicrobial | 93.2% | 76.4% |

| D4910 | Perio Maintenance | 89.9% | 79.2% |

Illegal Referral Loopholes

By law, non-licensed individuals cannot make healthcare referrals. Yet insurance companies create preferred provider networks—essentially closed-loop referral systems where patients are funneled to dentists who have agreed to their fee schedules.

This isn’t patient choice. It’s a marketing tactic that steers patients toward the lowest-cost providers so insurers can maximize profits. And it works:

- 82% of all dental plans are PPOs (American Dental Association, 2023)

- 88% of patients who seek dental care use insurance as their payment method (ADA Health Policy Institute dental utilization trends 2023)

- The insurance company now controls nearly 90% of the market—and uses that leverage to keep your reimbursments low and their profits high. REFERING CLIENTS POLICY HOLDERS INTO THIER NETWORKS.

- While your premiums go up, your benefits goes down.

What Gets Lost: Quality, Integrity, and Patient Choice

When insurance companies and in-network providers dominate a region:

- Reimbursements fall even further

- Quality materials become unaffordable under contract

- Dentists must cut time and cut corners—or burn out trying not to

- The free market of dentistry (where dentists build reputations on quality) is replaced by insurance gatekeeping

Many ethical dentists are left with impossible choices:

- Join the network and compromise

- Sell out to a chain dental or DSO

- Leave the profession entirely

- Or go out-of-network and risk fewer new patient calls. This is what Dr. Castellano chooses.

choices 1-3 are captulation that adds to the problem. This is the reality of today’s dental economy. Only 20% of dentists still practice fully independent, out-of-network care. tables 1 and 2

The DSOs -Insurance alliance cancer that is killing dentistry—and What It Means for You

44 out of 50 states have laws that require a dental office to be owned and controlled by a licensed dentist—yet DSOs use loopholes to reverse this principle. An owner dentist silently sits in the background as his licence is leased by the DSO or used to satisfy the law for ownership. Multiple franchised clinics are opened that he may never practice in while unlicensed managers, commission-based associate dentists, and insurance-fee rules dictate the actual care. All the real control—management, supplies, staff training, branding, marketing, pricing—is handled by the franchise. The so-called “owner-dentist” just signs off and collects checks.

The danger is what happens once one office turns a profit—they build more. But one dentist can’t be in five or ten places at once. These new offices are run by office managers who follow franchise protocols geared toward maximum profit-efficiency. The licensed owner hires the licensed dentists, yes—but then disappears from the care equation entirely. He becomes a distant figurehead while associates on commission do all the clinical work. He’s not a mentor. He’s not a leader. He’s a middleman to the franchise and insurance companies.

It’s an enticing model because it works—on paper. It strips down the dental office into a predictable, repeatable, high-volume “patient mill,” rather than the traditional, reputation-built, patient-centered solo practice. There’s no long-term patient relationship. There’s no continuity of care. The number of associates doesn’t matter—because they only get paid if they produce. If they don’t upsell or overtreat, their commision paychecks are low. They come and go like shift workers in a factory line that’s why you rarely see the same face twice at these offices.

These offices are built big—10 chairs or more. They need to be, because the management company keeps 80% of the revenue, while the dentist doing the work gets only 20%. That math doesn’t work unless you crank the volume. And remember, these offices are in-network with insurance companies that pay on 30–70% reduced fee schedules. That means more production is the only way to survive. The office becomes a quota-based machine.

The insurance companies play their role perfectly. They funnel thousands of their captive policyholders into these clinics, calling them “preferred providers.” Patients are steered into the in-network trap with promises of discounts. What they don’t realize is that those discounts come at the cost of quality. You get what you’re discounted into—high-volume, low-quality, inconsistent dentistry. Just look at the patient reviews for DSO chains across the country. They’re consistently awful. These clinics are only “preferred” because insurance companies profit more by underpaying dentists—and they know these corporate chains will take the hit just to keep the volume coming.

This isn’t some growing trend. This is the new normal. Private practices are getting bought up, gutted, and rebranded into chains. New DSO offices are being built from scratch every day. It’s all fueled by insurance profits—and the greed of licensed dentists who don’t want to practice anymore. They want ownership, passive income, and scale—without doing the work. It’s not dentistry. It’s real estate, marketing, and insurance volume leverage disguised as care.

It’s like cancer. Cancer multiplies uncontrollably, with no regard for what surrounds it—no contact inhibition, irregular cell structure. It absorbs everything around it to fuel its own growth. That’s exactly what this insurance-driven corporate dental ecosystem does. It has no regard for long-term patient care. The licensed dentists involved have abandoned the ethics and responsibility that come with their license. The profession is being consumed.

Cancer kills by starving and overwhelming the healthy tissue. In this case, the body is dentistry. More corporate, in-network control and less direct dentist oversight is the cancer: less incentive for quality, less ethical motivation, and more over-treatment. Because when you’re working on a 30-70% reduced fee schedule, there’s no room left for integrity—only for upselling.

This is monopoly-level mind control. Insurance companies have made themselves the dentist. They sell patients the idea that they’re saving money, that they’re covered—while they control every detail of who gets care, where, and for how much. Through clever marketing and discounts, they’ve replaced the dentist-patient relationship with a pre-approved in-network checklist and has handed over 90% of the market over to corporate dental. It’s why you don’t see doctors’ names on the doors anymore.

Since 1970, there’s been a 75% drop in private practices. Fewer than 20% of dentists still operate out-of-network, where they retain full control of pricing, materials, labs, and their own treatment standards. Everyone else has been pushed into network chains, where they’re told what to do, how to do it, and what it’s worth—by an insurance company that doesn’t do any dental work.

This isn’t innovation. It’s an extinction event—engineered by insurance, executed by DSOs, and made possible by dentists who forgot what the profession means.

🧭 Legal Violations and Antitrust Context

In‑network + Chain Dental = Monopoly

- The Sherman Act (Section 2) makes it illegal to monopolize or attempt to monopolize markets.

Price-fixing—coordinating prices—is explicitly illegal under this law. Violations carry

criminal and civil penalties.

- The Clayton Act prohibits mergers/acquisitions that substantially lessen competition—exactly what corporate DSOs are doing.

Yet insurers and DSOs exploit loopholes. State dental practice laws exist to keep dentistry in professional hands—but in reality, unlicensed business managers and corporate boards hold the reins.

- The

McCarran‑Ferguson Act once shielded insurers from antitrust scrutiny. But

CHIRA (2021) restored federal oversight, explicitly lifting that immunity for health/dental insurersADA+1AGD+1. Now, price-fixing and collusion by insurers are

legally actionable.

- The

American Dental Association has urged the DOJ to

enforce the Competitive Health Insurance Reform Act, citing limited insurer competition and calls for guidance and merger reviewBecker's Dental Review+1ADA+1.

🔍 Florida-Specific Law

Florida law is crystal clear:

“Only dentists licensed in the State of Florida or professional corporations composed entirely of licensed dentists can own and operate dental practices…”Health Care Law Matters

And Chapter 466 holds that practicing dentistry without a license is a felony pmc.ncbi.nlm.nih.gov+12flsenate.gov+12codes.findlaw.com+12.

Yet DSOs are flipping requirements on their heads: they lease the license, hire unlicensed bodies to run operations, and offload liability—subverting the law’s intent.

🛠️ Solutions Worth Considering

- Regulate insurers to prevent network price-fixing. Make them behave like true insurers: pay claims at submitted rates on fee schedules—not negotiated, suppressed network rates.

- Ban one-license multi-clinic ownership. One dentist should not remotely oversee 20 locations. Licenses represent

clinical responsibility, not absentee franchising.

- Restore mentorship and ethical patient transitions. Encourage dentists to transition gradually, mentor associates, and keep practice control intact. That preserves dignity, ethics, and continuity.

| Decline of Solo Practice | → | Rise of DSO / Chain Practices |

|---|---|---|

| Dentists can’t compete with 30–70% fee schedule cuts | → | Must join large DSO networks to survive |

| Out-of-network dentists lose patient volume | → | Insurance funnels patients into in-network chains |

| Solo dentists can’t match “discounted” rates | → | DSOs exploit volume and insurance subsidies |

| Insurance marketing promotes “preferred providers” | → | Patients associate affordability with chain clinics |

| Owner-dentists can’t scale or compete with private equity | → | Chains hire commission-based associates to meet quotas |

| Commission-based care model undermines ethics | → | Continuity and quality decline; turnover rises |

📈 Statistical and Historical Evidence

1. Correlation of Curves

- The decline of solo practice from ~95% in 1970 to ~20% by 2025 matches, almost inversely, the rise of DSO/chain control from ~5% to ~80% in the same span.

- This type of inverse trend over time is a textbook signal of structural replacement, not coincidence.

2. Insurance Market Share Expansion

- NADP reports that by 2020, 89%+ of insured Americans were on PPO plans—plans that promote in-network use through negotiated fee caps and "preferred provider" models.

- PPO reimbursement rates are often 30–70% lower than standard fees, forcing small offices either to go out of network or to join chains that absorb the losses via volume and subsidies.

3. DSO Subsidization and Commission Models

- DSOs collect monthly subsidies from insurance companies in return for participation.

- They pass the production pressure downstream to commission-based associates, a model unfit for solo practitioners who focus on quality over quotas.

4. ADA/HPI Ownership Trends

- Solo ownership has dropped sharply since 1999; the drop accelerates after every new wave of insurance enrollment growth and DSO expansion.

🎯 Logical Probability of Causation: HIGH

Given:

- Direct economic incentives created by insurance companies to steer patients toward in-network chains.

- Structural dependence of DSOs on reduced fee schedules.

- Incompatibility of these fee schedules with high-quality solo care.

- Timeline correlation and collapse of out-of-network options.

➡ The likelihood that insurance-led in-network price fixing and marketing is the primary cause of solo practice decline is very high—an estimated 85–95% probability when viewed through an economic systems lens. The probability that the decline of solo dental practices is causally linked to the expansion of DSO/chain dental practices through in-network insurance marketing and price-fixing is extremely high—not just correlation but a near-direct systemic connection. Here's why, using evidence, logic, and economic modeling:

📚 Supporting Citations

- ADA Health Policy Institute: Dental Practice Ownership Trends

- Pew Charitable Trusts: “Corporate Dentistry: Ownership, Access, and Accountability”

- NADP: PPO enrollment and provider network statistics

- Becker’s Dental DSO Review: Expansion of DSOs and effects on market share

- Sherman and Clayton Acts: Define price fixing and monopolization as anticompetitive behavior.

🧠 Bottom Line

Cause, not coincidence.

Insurance companies have

manufactured the shift through pricing power, marketing language, and control over provider networks. DSO chains are the

delivery mechanism, not the origin—insurance is the architect. The decline of solo dentistry is the

natural outcome of a rigged economic model.

table 2 in-network dentists vs out of network effects on quality of care

| Feature | In-Network PPO Dentist | Out-of-Network PPO Dentist |

|---|---|---|

| Contracted with PPO? | ✅ Yes | ❌ No |

| Follows PPO Fee Schedule? | ✅ Yes – Accepts 30–50% Reduced Fees | ❌ No – Charges Usual Office Fees |

| Who Gets Paid by Insurance? | Insurance Pays Dentist Directly | Insurance May Reimburse the Patient |

| Treatment Control | ❌ May Be Limited by PPO Rules | ✅ Full Clinical Freedom |

| Use of Best Materials/Labs | Often Limited to Cost-Based Choices | Dentist Chooses Highest Quality |

| Common in Corporate Chains? | ✅ Frequently | ❌ Rarely |

Why choose us over a corporate franchise for your dental work!

We refuse to compromise your care. That gives us the freedom to:

✅

Spend real time with you — Not rush you through like a number

✅

Use the best labs and materials — No shortcuts, no cheap substitutes

✅

Offer honest, personalized treatment — Not limited by insurance checklists or quotas

✅

Do what’s right for your health — Not what’s cheapest for your insurance

✅

Avoid commission-based dentistry — No upselling, no sales pressure, no production goals

In many chain or in-network clinics, care decisions are controlled by a corporate operations manager, not your dentist. These offices are often run by dental service organizations (DSOs) that treat patients like a business line—not individuals.

At our office,

Dr. Castellano owns and operates the practice himself. You see the same dentist every time, and every decision is made based on

your health, your timing, and your needs—not someone else’s spreadsheet.