How Dental Insurance Companies Rig the System

Insurance companies raise premiums every year, yet lower reimbursement rates for dentists—forcing providers to work harder for less. This has nothing to do with improving patient care, and everything to do with maximizing corporate profits.

They’ve built a monopolistic grip over dentistry, controlling over 150 million Americans through restrictive PPO plans. Here's how it works:

🔁 The Insurance Playbook:

- Step 1: Secure a region by flooding it with in-network contracts (DSOs, chains, and group practices).

- Step 2: Funnel the majority of patients (about 60% of the market) into these network providers.

- Step 3: Once enough providers are locked in, they lower the UCRs (Usual, Customary, and Reasonable fees).

- Step 4: Dentists are now “preferred providers” in name only—forced to work at deep discounts with little say.

🧨 The Fallout:

- Independent, out-of-network dentists are squeezed financially, pushed out of the market, and labeled as "too expensive"—even when they provide more personalized, higher quality care.

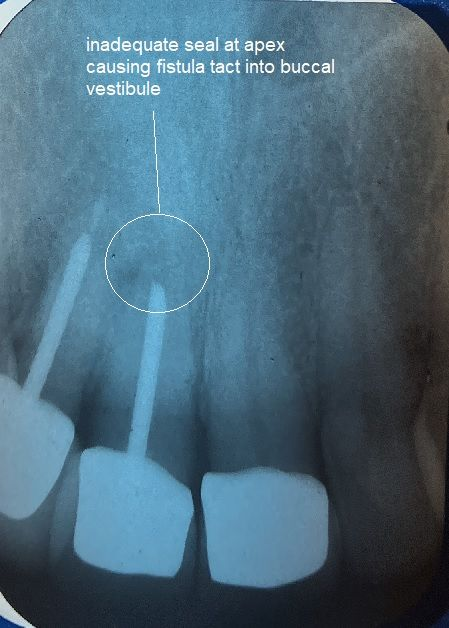

- Corporate chains (DSOs) benefit the most. Their model is built on high volume, low-quality care, incentivized by quotas and production bonuses—not patient outcomes. They compete for insurance contracts not for your business. Accepting lower fees doing lower and lower quality work to stay "in network" The result of this model works to funnel more money into the insurance companies and directs the policy holders into low quality corporate dentistry with little to no choice.

- Dentist-controlled practices, by contrast, focus on quality, trust, and long-term relationships—but can't survive under slashed fee schedules and insurance manipulation. Inflation mandates higher prices yet insurance companies are paying 5% less then what they did 10 years ago.

- Decline in private practice ownership / increase in corporate-/group-practice affiliation. According to data from the American Dental Association (ADA) Health Policy Institute (HPI), private-practice ownership among U.S. dentists has dropped: from ~ 84.7% in 2005 to ~ 73% in 2021. ADA+2DrBicuspid.com+2

- Sharp drop among young dentists. In 2021, only ~9.5% of dentists under 30 owned their practice — down from ~25% in 2005. DrBicuspid.com+2ADA+2

- More dentists affiliating with corporate group models / DSOs (dental service organizations) or private-equity–backed practices. There is documented growth in private equity affiliation: the percentage of dentists affiliated with private equity rose from ~6.6% in 2015 to ~12.8% in 2021. ADA News

- U.S. dental profession is shifting toward fewer solo/private practices and more corporate or group-owned practices, with younger dentists less likely to own a practice right away

- experienced dentists are leaving private practice or selling out, while new dentists enter corporate-controlled chains” are real trends.

🎯 The Real Goal:

The goal isn’t to care for patients—it’s to centralize control, reduce payouts, and create a corporate delivery system for dentistry where profits go up for the insurance companies, and the soul of the dental profession is lost.